Even though money isn’t everything, it does buy you options and freedom in life. We’re not talking about six or seven figures, but even starting with saving $10k in savings.

What are the best ways to use $10,000?

- Down payment for a house

- Emergency fund if you lose your job

- House maintenance like a leaky roof

- Pay for emergency medical bills for you or your pet

- Pay down student loans

- Pay off high-yielding credit card debt

With our help, you can save $10,000 in 52 weeks, even on a low income. It takes patience and discipline to learn how to save $10k in a year.

- How To Save ,000 Fast?

- How to save ,000 in 6 months chart

- How Long to Save ,000 Dollars?

- How Long Does it Take The Average Person to Save ,000?

- Can You Save Money While on Minimum Wage?

- How to Save ,000 in 2 Years?

- How to Save ,000 in 8 Months?

- How to Save ,000 in 6 Months?

- How to Save ,000 in 5 Months?

- How to Save ,000 in 3 Months?

- What is The Best Way to Invest ,000?

- Ways For Teens To Make Money and Save k

- How Much Do Minors Get Taxed on k?

- How To Save 10k Summary

How To Save $10,000 Fast?

The median household income in 2019 was $68,703, according to the Census.

Here’s the breakdown of monthly expenditures and budget percentages:

Learning how to save up to 10k in a year is easier than you think. But, if you have a family, you must also get everyone else to buy-in. Each family member must keep each other accountable to save $10,000 in a 52-weeks.

Lee También Cómo vender en Poshmark rápidamente - Guía de 2022 consejos y comisiones

Cómo vender en Poshmark rápidamente - Guía de 2022 consejos y comisionesWe are using the monthly expenditures infographic and going to go line by line to address how you can lower your monthly expenses.

1. Housing

Housing is the highest monthly expense for most Americans. All mortgage lenders will tell you it’s best to keep your monthly housing costs at or below 30% of your gross income.

How do you save money on housing costs?

If possible, lower your monthly payment by lowering your mortgage rate.

For example, the average house price in the US was $284,600 in May 2020, according to the NAR.

Lowering your interest rate by .25% saves $26 per month per $100,000. Based on $284,600, that saves you $74 per month or $888 per year.

Lee También Scrap Yard Near Me: 14 Steps To Get Cash For Metal

Scrap Yard Near Me: 14 Steps To Get Cash For MetalYou’re almost 1/10 on the way to saving $10,000 fast!

Imagine if you can lower your mortgage rate by 0.5% or an entire percentage point!?

2. Transportation

Second only to housing, American’s spent over $9,600 a year on car payments and regular vehicle maintenance. Cars cost over $800 per month for the average household in 2019.

Best way to save money on cars include:

- Refinancing at a lower rate – Visit your local credit union for a lower monthly car payment

- Maintenance – Perform recommended vehicle maintenance like oil changes and replacing the engine filter will allow the car to last longer.

- Tires – Check the air pressure on used tires, especially after the seasons change from cold to hot or hot to cold. Proper tire pressure and wheel alignment will help you save gas and prolong the tire’s life before replacement. Many places give free air for tires.

- Buy pre-owned – Buying a car that has pre-driven miles will save you thousands of dollars. Either buy a car with a remaining warranty or buy a pre-owned certified vehicle with more miles but comes with a manufacturer’s extended warranty.

- Gas app – Download the best apps to save money on gas for your mobile device. You can save several dollars per refill by buying the cheapest local gas. Also, consider refilling when you’re visiting your local warehouse club, like Costco or Sam’s Club gas station; they tend to have the cheapest gas in the area.

Alternatively, if the cost of a car is over $800 a month and you can sell it, you’d be able to save $10k fast!

See our guide on how to use the air pump at a gas station.

3. Taxes

The average household pays about 12% of their annual budget in taxes, over $8,200 on average. No wonder people hate paying taxes.

Lee También ¿Es posible tener un descubierto con la tarjeta Cash App? Resolver el saldo negativo de la App de Caja

¿Es posible tener un descubierto con la tarjeta Cash App? Resolver el saldo negativo de la App de CajaHere are the best tips to cut your tax bill this year:

- Contribute to your 401k – A traditional 401k allows you to deduct your contributions from your annual tax filings. Investing in a 401k is especially worthwhile if your employer matches your contributions and gives you free money to save for retirement.

- Fund your FSA – FSA contributions are deducted from your taxable income. Examples of FSA-eligible items include contact lenses, blood glucose monitors, breast pumps, orthopedic supports, condoms, denture cream, eye drops, lip balm, reading glasses, eyeglasses, shoe insoles, nasal spray, sunscreen with SPF rating of 15 and above, vaporizers, inhalers, thermometers, and wheelchairs. The drawbacks of an FSA include the money does not grow, and unused funds are lost.

- Fund your HSA – An HSA account allows you to pay medical expenses tax-free. Many people fund their HSA as an IRA alternative.

- Fight your property tax – Appeal your property tax on the local level. Start the appeal process to lower the assessed value of your property to lower your property taxes. The tricks to lowering your property taxes include finding comparable local homes for discrepancies, making any exterior or buildable changes before an assessment, and looking for local exemptions such as age for a tax freeze. Appealing your property taxes can potentially save you $10,000 in 3-5 years.

4. Household Utilities & Maintenance

In 2019, Americans spent over $7,500 on household maintenance and utilities like electricity, heat, water, garbage disposal, and the like. Most utilities are non-negotiable, but many little things add up to real savings.

What Are The Best Ways To Lower Your Utility Bills?

- Replace light bulbs – Replace all your incandescent light bulbs with LED. An LED light bulb is 3-times cheaper and lasts about 50 times longer than an incandescent light bulb.

- Replace old appliances – Replacing a 20-year-old fridge with a comparable ENERGY STAR model can potentially save you $150 per year with a relatively short payback period. Also, in many cases, you can get cash for your old refrigerator by recycling it with your local utility. See our guide on places that remove appliances for free.

- Compare electricity and gas rates – Every year or two, you should shop for your electricity and lock in the utility company with the lowest rates. In Illinois, I’ve switched around between ComEd, Constellation Energy, and NRG.

- Fix leaky toilets – If you hear a dripping faucet or a running toilet, fix it immediately! A running water toilet can waste thousands of gallons of water each month. Your water bill can be $200 higher or around $2,400 per year if you don’t fix it. Go to YouTube and learn how to fix a leaky faucet or temporarily turn off the water valve and use another sink.

- Turn down the heat – Put on a sweater if you’re cold in your house. Each degree lower on your thermostat will generally save you 3% on your monthly heating bill.

- Use ceiling fans – Ceiling fans used with an air conditioner can save 4-8% on cooling costs.

- Lower the water heater temperature – Lowering your water heater temperature to 120 degrees can save 6-10% each year on heating costs, according to the EPA.

- Replace shower head – Replacing your old showerhead with an energy-efficient shower head will reduce the flow rate and cut your water usage by up to 50%.

With these changes, you can easily save $10,000 over the life of a house.

5. Food

The average American household spends over $3,000 per year and over $250 per month eating out. On average, Americans eat out almost six times a week.

It’s over 3-times more expensive to eat out vs. the cost of groceries to make the same meal. Also, ordering the same meal from a food delivery company costs almost five times more expensive than preparing food at home.

What Are The Best Ways To Save Money on Groceries?

- Buy store brands – Buying a store brand is generally at least 25% cheaper than comparable name brand products.

- Make a shopping list – Having a shopping list allows you to stick to a plan which saves money and time.

- Check unit prices – Most stores have the unit price posted on the price tag. All things being equal, buy the item with the lowest unit price. But, don’t buy a larger size because the unit price is lower if it’s going to waste. For example, don’t buy a big box of beef broth if you only need a cup for a recipe.

- Shop the sales cycle – The grocery store tends to rotate sale items within a category. For example, broccoli is on sale this week, and cauliflower is next week. Only buy fruits, vegetables, and the cheapest meat that’s on sale any given week.

- Buy discount gift cards – Many sites sell grocery store gift cards at a discount. A resold gift card for a grocery store tends to be discounted 1-10%. All savings add up! The average household spends $3,768-$6,000. If you buy grocery gift cards for 5% off, you’ll save between $189-$300 per year using sites like Raise.com.

Most people cannot save 10k from food expense spending alone, but eating at home will bring fast results.

6. Insurance & Retirement Contributions

Retirement contributions are among the few categories in your budget that I’d like to see go higher. It defers your taxable income, reduces your current tax obligations, compounds money for retirement, and you’ll get free money if your employer matches a percentage of your contributions.

Lee También How Much Does An Oil Change Cost At Walmart? Prices Near Me

How Much Does An Oil Change Cost At Walmart? Prices Near MeWhat are the Best Ways to Lower Insurance Premiums?

- Shop around – Every year, you should shop your insurance. Some companies are more competitive during some years while others are charging current customers for past company losses not related to your insurance.

- Check premium before purchasing – Don’t buy a new or used car until you check the insurance premium. The cost of the vehicle is the major factor. Other insurance premium variables include engine size, cost of repairs, probability of theft, and vehicle safety record.

- Consider higher deductibles – Your insurance premium will go down the more you raise your deductible. You can easily save 5-10%, if not more, on your insurance premium by raising your deductible. Put the money you save from your annual premium in a savings account, so it’s ready if you ever have an insurance claim and need to pay your higher deductible.

- Good credit score – Your credit score can and often is used to calculate your insurance premium.

- Low Mileage insurance discount – Car insurance companies usually base your car insurance rate on the national average. The average person drives about 13,5000 miles per year, according to the US Department of Transportation Federal Highway Administration. You’ll likely qualify for a low mileage insurance discount if you drive less than 7,500 miles per year. Working from home part-time or full-time may become more common, making 7,500 miles or less a higher likelihood. Also, pay-per-mile car insurance is becoming more popular for part-time drivers to save money.

- Bundle Insurance – Bundling your insurance with the same company can save up to 25% in premiums vs. having multiple policies.

Reducing your insurance and contributing to your retirement will teach you how to grow and turn 10k into $100k until retirement.

7. Debt Payments and Savings

You’ll have difficulty getting a mortgage if your debt-to-income ratio is higher than 43% of your annual income. Most mortgage lenders suggest a ratio of 36% or lower. The average American has over $90,000 in debt, including mortgages, student debt, credit cards, and personal loans.

Best Ways To Lower Your Debt Payments

Here are ways to reduce debt quickly:

- Pay more than the minimum – Paying the minimum payment on your credit card can easily take over a decade to pay it off. It’s usually best to start overpaying the debt with the highest interest rate first.

- Side hustle – Find a side hustle to make extra money such as becoming a pilot car driver, get paid to deliver cars, get paid to do homework, side jobs with a pickup truck, proofread for money, online transcription jobs for beginners, under the table jobs, mystery shopping jobs, and more.

- Ask to lower interest rate – Call and request a lower rate on your interest rate. Negotiation tactics include telling them you’ve been a loyal customer, ask for a temporary reduction, or try calling back for a different agent.

- Balance transfer – Some balance transfers offer 0% APR for up to 18 months. You’ll likely have to pay a balance transfer fee, but it’s still cheaper than the high APR with your old credit card; also read the details. The benefits of a balance transfer include consolidating debt, getting a lower interest rate, getting better terms, reduce debt faster, and potentially get perks and rewards with the new credit card.

Reducing your debt load and getting a side hustle will help you save 10k fast! The busier you are, the less likely you are to spend on unnecessary things.

Reasons To Save Money

According to Planning & Progress Study, the average American had $69,500 in personal savings, excluding retirement money, according to Planning & Progress Study. The rule of thumb is to have three to six months’ worth of money in combining short-term CDs and high-yield savings accounts. According to the BLS, the average time someone was unemployed in 2021 was almost 30 weeks, when seasonally adjusted. You’ll need almost seven months of savings to offset the loss of income from being unemployed.

Loan & Debt Consolidation

Consolidating existing loans into one manageable monthly payment can decrease interest payments, and make paying off your principal balance an easier task. It can be achieved through debt consolidation loans, refinancing your mortgage at historically low rates, or you could refinance student loans with plenty of online options available to you today.

Lee También 6 Best 12V Battery for Winch (ATV, Trailer, Jeep, Stand Alone, Optima)

6 Best 12V Battery for Winch (ATV, Trailer, Jeep, Stand Alone, Optima)8. Healthcare

The United States has the most expensive healthcare costs in the world, according to Investopedia. Prescription drugs, doctors, hospitals, and nurses charge more than any other country.

What are the best ways to lower your healthcare costs?

- Save money on medications – People over 65 years old pay over $455 annual for out-of-pocket prescription drugs. The best ways to save on prescriptions include pharmacy savings cards, prescription coupons, buy generic brands, try alternative medications, request a free 90-day supply of samples, use GoodRx to compare prescription drug prices and try changing your insurance plan if it doesn’t pay for your regular medications.

- Outpatient facilities – Urgent cares are likely cheaper than going to the ER.

- Choose in-network providers – You’ll pay much less for in-network health providers vs. you paying the majority out of pocket for anyone outside the network.

- Maximize your benefits – Some healthcare plans offer free annual checkups with bloodwork and vaccines. Many plans also offer discount gym memberships and eyewear.

- Choose the right health plan – If you are healthy and rarely need healthcare, choose a high-deductible plan to save on your premium. A higher premium plan makes sense if you have health problems and want a wider selection of medical providers.

- Use your HSA or FSA – The health savings accounts are pre-tax dollars that can save you hundreds of dollars per year if you maximize the benefit. Understand the rules, the timing, and your needs to save the most money. Pay extra attention to your FSA because you can potentially lose your invested money if you don’t use the funds annually.

9. Entertainment

The average American spends over $2500 on entertainment annually. Here are the best ways to save money on annual entertainment expenses:

- Free reading and videos – Go to your local library and use their free educational and entertainment resources such as magazines, videos, audio CDs, books on tape, newspapers, and more. Cancel all your magazine and newspaper subscriptions and get them for free at your nearby public library.

- Make money from a hobby – Finding a hobby that makes you money is a dream come true! Examples of hobbies that make money from home include selling clothes on Poshmark, upcycle clothes and sell at consignment shops, make money online as a college student, flip things you make for a profit, and more.

- See a matinee – An early bird movie can save 50% off the price of a regular priced ticket.

- Rent movies for less – Buying a new DVD movie release will cost around $20 or renting online through Comcast, Amazon, or Apple costs around $6-$10. Instead, rent the newest movie releases at Redbox for only $1.50 per night or $2 if you want to upgrade to Blu-ray. It’s even cheaper if you check out the movie from your local public library. The waitlist grows fast at the library, but I’ll go on the “hold” list several months before the movie is released.

- Happy hour – I try to meet people at restaurants with a happy hour menu with food and drink specials. Most happy hours near me end at 5 or 6 pm. Other restaurants have daily specials that go all day, such as $2 tacos or $5 burger specials. Avoid eating out on Saturday to save money! Go out for a Friday happy hour after work and school. Also, many restaurants offer Sunday family packs of food that feed four people.

- Free concerts – It’s easy to Google “Free outdoor concerts in [your zip code].” For example, Michigan has a site called, Local Spins with a running list of free outdoor community concerts. Check your state travel bureau, local newspaper, or website for free things to do nearby.

- Avoid ticket surcharges – Try to avoid buying entertainment and sporting tickets online due to high surcharges. In some cases, I’ve seen the surcharge cost surpass the price of the ticket! If possible, buy your tickets directly from the venue’s ticket counter to avoid extra fees.

- Group discounts – Visit sites like Groupon and LivingSocial for discount entertainment. You can easily save 50% on entertainment or dining out.

- Lower your cable bill – The average internet and cable bills are over $50, and many bills are hundreds of dollars per month. Being a loyal customer doesn’t pay! Call your cable and internet service to negotiate a lower price. See our guides on steps to lower your Comcast bill for existing customers or steps for lower AT&T Uverse deals.

10. Cash Donations

There are many good reasons to give cash donations, including the trust of an organization, belief in the cause, you won’t change, or there’s a personal connection to the cause. Another good reason is the tax benefit from donating to a charity. According to IRS Publication 526, you can deduct up to $300 of cash donations on your tax return without itemizing.

Also, many people clean out their houses in the spring and fall. The bags and boxes of donations go to places like Goodwill. It’s essential to keep good records in case you get audited. I always take photos of my donations and itemize everything.

If you’re like me, I never knew how much to claim for each deduction. Consider using a free online tool like ItsDeductible to help value charitable donations. It tracks your donated items, mileage, travel expenses, and cash each year. I use to guess, but the online donation tool suggests a value on nearly every item. I was underestimating my donations for too many years before discovering ItsDeductible.

Ways to Make Money from Donations

There are unique ways to make money by donating your body, such as:

Lee También 36 trucos y consejos de Southwest Airlines (Códigos promocionales y ofertas de descuento) 2021

36 trucos y consejos de Southwest Airlines (Códigos promocionales y ofertas de descuento) 2021- Plasma – Donating plasma is relatively painless and pays between $20-$35 a pint. Most blood donation places allow you to go twice in any seven days, with at least two days in between. You can make between $160-$280 per month by donating plasma. Donors must be at least 18 years old and weigh at least 110 pounds to donate plasma. Use our guide for the highest paying plasma donation places nearby.

- Breast milk – Some moms produce too much while others produce little or no breast milk. A breastmilk resale marketplace is OnlyTheBreast, where you post an ad in the community; OnlyTheBreast is an alternative to Craigslist. People tend to sell breast milk for $1.50 to $3.00 per ounce. A baby usually drinks 20-35 ounces per day. At $3 per ounce, you can make between $60-$105 per day selling breast milk.

- Sell your hair – There are buyers of long and healthy hair. You can sell your hair for between $10-$30 an ounce. The price will vary depending on the quality and color of your hair. Places to sell your hair include local wigmakers, doll makers, eBay, and eBay alternatives.

11. Apparel and Personal Care

To save $10,000 a year, you’ll need to cut discretionary spending, like clothing. According to ClosetMaid, the average person has over 100 items of clothing in their closet.

You know, if you have too many clothes when your closet is overloaded, keep clothes for sentimental reasons, you lose clothes in your closet, keep clothes that don’t fit, you have a skinny and fat section of clothing, and you have clothes with tags still on. Stop buying more clothes!

What Are The Best Ways To Save Money on Clothes?

There are many ways to reduce your clothing bill, including:

- Sell unused clothing – There are several ways to sell used and unused clothing. Sell your clothes fast on Poshmark or sites like eBay.

- Sell unwanted clothing – If you’re not computer savvy, then find the best nearby consignment shopusing our guide.

- Buy clothes cheap – First, never pay full price for any clothes. The average clothing markup at most department stores and boutiques is 50-80%. Many sites buy cheap trendy clothes online with free shipping for adults, kids, weddings, and plus sizes. Also, checkout shopping sites and apps like Wish to buy clothes directly from the manufacturer. They sell t-shirts as cheap as $5 and wedding dresses as low as $100. Wish is also a great place to buy discount shoes online, including boots, sneakers, sandals, and more.

- Use online coupons – Clothing stores offer online and in-store coupons. They need foot traffic to sell all their high-margin clothing items and accessories. Instead of being on several email lists, you can see our guide on the best online coupon sites to find digital and printable coupons.

- Be gentle with your clothes – Take care of your clothes because they are not indestructible, even if it says machine-washable. I wash most of my clothes inside-out on the gentle cycle in cool water. Depending on the clothing, I either use the lowest heat setting on my dryer or let my clothes air-dry. Many of my clothes are over a decade old and still look like new.

- Find a good tailor – Most of my clothes were too big on me when I lost weight. Instead of buying a whole new wardrobe, I had my tailor make things like my shorts smaller in the waist. I also took my belts to a leather shop and had them take off a couple of inches. Taking clothes to a tailor is cheaper than buying new clothes in most cases. See our guide on dry cleaning prices list.

- Buy out of season – Retailers run sales on clothes all year, but the best sales are when it’s at the end of the season or out of season. There’s nothing wrong with buying a winter coat in May for 70-80% off or swimwear in December.

- Sales don’t make you money – Just because you bought it on sale doesn’t mean you saved money. Only buy clothes when you need them. Do you really need another pair of jeans or a black shirt or blouse? Probably not.

- Buy clothes that fit – I use to buy clothes because they were on sale for 70%-80% off, but they didn’t fit right. It was a terrific shirt, but the sleeves were too long, and it was bulky. The shirt would sit in my closet with the tags because I didn’t feel good in it. Only buy clothing that fits when you buy it.

12. Education Debt

Student loan debt is only second to mortgages. The average student debt is over $32,700, according to the Federal Reserve. It’s up over 20% since 2015-2016. Even worse, over 600,000 student borrowers have over $200,000 in school debt.

Here are some of the best ways to reduce student loan debt and improve your ratios:

- Ask your employer – When job hunting, check if they have or are willing to offer student loan assistance as part of your employee benefits.

- Pay extra – Try paying extra money each month to reduce your interest cost and pay down your principal faster. Always pay extra toward the loan with the highest interest rate first.

- Pay ahead – The Perkins Loan doesn’t start accruing interest until after graduation. Either set money aside in a high-yielding saving account or start paying before the grace period ends. This will reduce the amount of interest you pay to finance your education.

- Autopay discount – Many student loan servicers and lenders offer an interest rate reduction of 0.25% when auto debiting your checking or savings account each month. It consistently provides the lender with cash flow, lower transaction fees, and more assurance they will receive payment each month. It gives the student loan lender notice if you’re struggling to pay and prevent a debt collection demand letter.

- Forbearance or deferment – Student loan forbearance and deferments allow you to pause your payments temporarily. The process stops interest from accruing for certain types of student loans. Potential eligibility requirements to defer your student loan include changing jobs, unemployment, financial hardship, medical expenses, or military deployment.

13. Miscellaneous Ways to Save Money

When it comes to saving money and reducing debt, nothing beats free! You may not realize there are many things you can get for free without paying.

What Things Can You Get For Free?

- Online Marketplaces – Site like Craigslist, Facebook Marketplace, Nextdoor, and OfferUp have sections where people give things away for free. You can find free stuff like hot tubs, large furniture, appliance, plants, swing sets, and more. In most cases, the seller will expect you to bring a pickup truck to haul away the stuff with one of your buddies.

- Free laptop and internet – Low-income families can qualify for free government internet and laptops. The primary qualification starts with income limits. See our guide on free Internet service and laptops from the government.

- Get free appliances – The government offers assistance to those designated as low-income or disabled to get free appliances. The program helps replace old and less-efficient appliances with new ones. The Low Income Home Energy Assistance Program also helps with heating and cooling bills, repairs related to energy, and home winterization.

- Get free vet care – Some agencies can help with costly veterinary care expenses. The amount of money for assisted pet care can vary. See our guide on cheap or free vet care nearby for low income families.

- Free stuff for teachers – Most people agree that teachers are underpaid. Thankfully there is a ton of free stuff for teachers by mail and online.

- Free shoes – It’s true; there are legit ways to get free shoes online, like Nike. Most of the programs are tester programs that lend you new shoes to use for several months. Some shoe companies expect you to send them back, while others give you free shoes in exchange for completing a survey.

- Free Land – There are ways to get free land in the US. Several cities around the US offer homestead land in small towns, farm communities, and cities. Complete the application for your desired area to see if you meet the criteria for free land. See our guide on the states with free land and government grants.

- Free books by mail – There are simple ways to get free books by mail for babies, teachers, babies, kids, and adults.

- Free haircuts – The average man spends about $24 per haircut vs. a woman spending about $55 per visit. We have a guide on the best places to get free haircuts nearby.

- Free diapers – The average baby uses 8-12 diapers a day, or up to $80 per month, according to the National Diaper Bank Network. We have a guide on ways to save money and get free diapers.

How to save $10,000 in 6 months chart

Saving $10,000 in 6 months will require you to make goals, cuts costs, don’t make excuses and make automatic deposits. Post our chart to save $10,000 in 6 months.

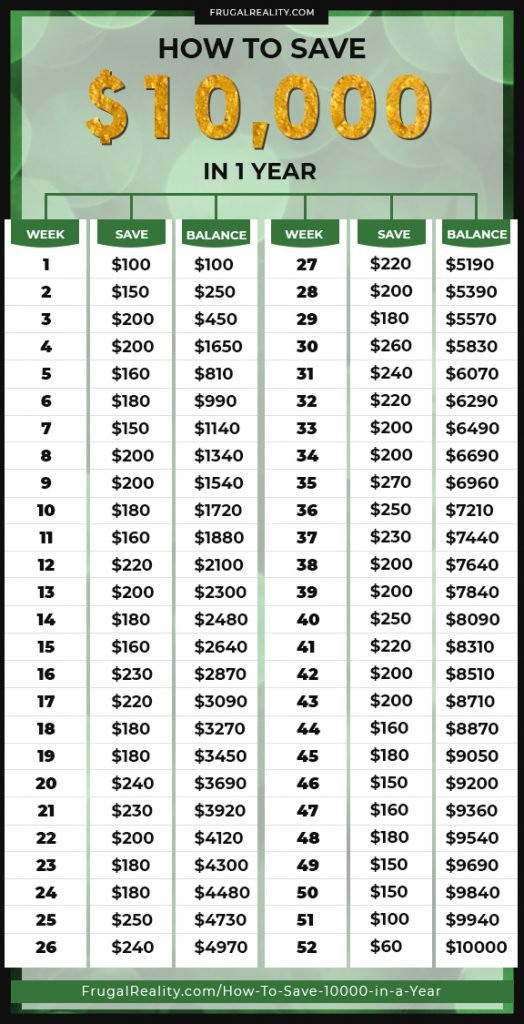

How to save $10,000 in a Year Chart

Saving $10,000 in a year is possible if you stay disciplined, don’t lie to yourself, cut our excess expenses, and automatically withdraw the funds from your check into a savings account. Use our chart to save $10,000 in a year.

How Long to Save $10,000 Dollars?

If you have consistent income, it’s easy to back into a savings goal. Take $10,000 and divide it by your ideal time period for your financial goal. Below, we’ve calculated how long it will take to save $10,000 over some popular timelines.

Be realistic with your obtainable savings goals. Everyone’s situation is different.

How Long Does it Take The Average Person to Save $10,000?

The average household income in 2019 was almost $69,000. Housing, transportation, household maintenance, and utilities are about 41% of the average budget. Entertainment is another 4% of the average yearly budget.

Saving $10,000 will depend on your specific situation and your discipline. You can make $10,000 fast by selling your car and working from home, and eliminating your transportation costs, car maintenance, gas, and insurance. But, selling your mode of transportation isn’t realistic for most people. Instead, consider a side hustle to make some extra cash.

Can You Save Money While on Minimum Wage?

You can always start saving money while on minimum wage. There are brokerage firms that have no minimum IRA contributions to open an account. Save $5 and open an account at Betterment or a place with no minimum retirement accounts. Betterment is one of the rare Robo-advisor firms that don’t require a minimum deposit.

Otherwise, consider opening a high-yield savings account at an online bank like Marcus.

How to Save $10,000 in 2 Years?

The average household would have to save just over 7% of their annual income to save $10,000 in two years.

Here’s how much money you need to save in order to grow $10,000 over 2 years:

Monthly savings: $416.67

Weekly savings: $96.15

A family of four can save $100 per week by not going out to eat once a week. The average four-person meal at a restaurant costs about $75-$100. It costs even more for adults drinking and ordering dessert.

How to Save $10,000 in 8 Months?

Based on the median average household income, you’d have to save about 22% of your pay for saving 10k in 8 months.

Here’s how much money you need to save in order to save up to 10k in 8 months:

Monthly savings: $1,250

Weekly savings: $312.50

Saving the money in eight months is doable if you can refinance your mortgage, negotiate with your utilities, lower your insurance, cut entertainment costs, and cook more meals at home.

How to Save $10,000 in 6 Months?

The average household would need to save almost 29% of their annual household income to save $10,000 in 6 months. Though it’s not impossible, it takes discipline. You’d have to follow all the steps in our guide, refinance your mortgage to a lower rate, trade down to a less expensive car or sell it, stop eating out at restaurants, and cut your entertainment costs.

Here’s how much money you need to save in order to grow $10,000 in six months:

Monthly savings: $1,666.67

Weekly savings: $384.62

How to Save $10,000 in 5 Months?

Based on the average household income of almost $69,000, you’d have to save 35% of your gross income in 5 months. To save $10k fast, you’d have to drastically cut your expenses and get a side hustle to make money fast immediately. The best side hustles you can do today include ridesharing, deliver food and groceries, online tutoring, buy and resell stuff, or online freelancing.

Here’s how much money you need to save in order to grow $10,000 in 5 months:

Monthly savings: $2,000

Weekly savings: $500

How to Save $10,000 in 3 Months?

Assuming you don’t make 6-figures or 7-figures a year, it’s going to be difficult to save $10,000 in 3 months. Assuming the average household income is just over $68,000, you’ll need to save 58% of your gross income. You likely can’t save $10k fast by just cutting unnecessary expenses.

You should read our Great Depression survival tips guide and get a side hustle to make quick cash.

Here’s how much money you need to save in order to grow $10,000 in three months:

Monthly savings: $3,333.35

Weekly savings: $833.33

What is The Best Way to Invest $10,000?

I saved $10,000 dollars, now what?

Always pay yourself first! Consistent investing will let the power of compounding build wealth.

Invest in Retirement Plans with Employer Match

The best investment for 10,000 dollars is an employer match of a 401k, 403b, ROTH, or other plans. A typical employer match formula is a 100% match of the first 3% you contribute, then the employer will match 50% of the following 2%, per Fidelity Investments.

You can potentially receive thousands of free dollars each year, depending on your annual income. For example, if you contribute to maximizing your employer’s match, you’d contribute $2,5000, and your employer would give $2,000. You’d have $26,200 in 30 years, assuming your money compounds at 6% annually. It’s one of the smartest ways to turn 10k into 100k.

Max Out Your IRA

A traditional IRA allows you to tax-defer growth until you start taking distributions at 72 years old. The opposite is a ROTH IRA that has you pay the taxes up front, but you will be able to take the money tax-free at retirement.

The annual contribution limit for an IRA in 2021 is $6,000, or $7,000 if you’re 50 or older.

Pay Off Credit Card Debt

The average credit card interest rate in 2020 was over 16%, according to the Federal Reserve. Paying off high-interest credit card debt is the best way to invest 10k short-term; it’s a guaranteed return. The report also had the average credit card debt for a US household at $6,270. You can easily save $10k over the long-term by paying off your balance and not just making the minimum payment for several years.

You can improve your savings by taking advantage of a balance transfer credit card with an introductory zero rate.

Invest in a Taxable Account

Open a taxable investment account once you’ve maximized your retirement contributions and paid off your credit cards. Select a low-fee target-date retirement fund at a low-cost investment firm like Vanguard, Fidelity, or Schwab.

Even investing an additional $10 per month can add up. If you invest $10 per month for 30 years and it compounds at 7%, you’ll have over $10k.

Start an Emergency Fund

You should have at least 3-6 months of pay in an emergency fund. The top reasons you need an emergency fund include job loss, major dental or health expenses, pet care, home or car repair, or unexpected tax bill.

Place your emergency fund money in a high-yield savings account. It’s the best way to preserve capital, make a return on investment, and have liquidity so you can access your money when needed.

Save for College

Funda 529 plan for your kids or your own education expenses. The earnings in the 529 plan grow tax-free and won’t be taxed for withdraws if used for qualified school expenses.

The top benefits of a 529 plan include some states offer tax breaks, it’s a low maintenance type of investment, flexibility to change your investment option up to twice a year, simple tax reporting, and anyone is eligible to invest, unlike Coverdell Education Savings Accounts and Roth IRAs.

Additionally, you can use a 529 plan to make money while in grad school.

Funda HSA Account

A health savings account is a type of savings account that allows you to set pre-tax money aside for qualified medical expenses. The money deposited is not taxed and can be used immediately or at a future date.

Many people use an HSA as an additional retirement plan. You can invest the HSA funds just like an IRA. You can let your investment balance grow and compound and not spend the money until after you retire. An individual can contribute up to $3,600, and a family can contribute up to $7,200 in 2021.

The disadvantage is that you must have a high-deductible health plan to qualify.

Real Estate

Real estate investing benefits include tax advantages, passive income, leverage, and diversification. Learning how to invest 10,000 dollars in real estate will depend on your risk tolerance, active or passive management, and investment time horizon.

Pay Down Your Mortgage

The most conservative way to invest $10k in real estate is to pay down your mortgage. There’s peace of mind when you pay off your house and know you own it.

Invest in REITs

A passive way of investing $10,000 in real estate is buying a real estate investment trust (REIT) that offers a way to participate without having to operate, own, or finance properties. REITs can include telecommunications infrastructure, mobile home parks, temperature-controlled warehouses, cultivation facilities, hotels, apartments, single-family homes, office buildings, data farms, self-storage facilities, student housing, retail or warehouse buildings, hospitals, and more.

Buy a Rental Property

Use $10k as a down payment for a rental property for more hands-on real estate investing. The benefits of owning a rental property include tax benefits, cash flow, and potential appreciation. The drawbacks include maintenance costs, lack of liquidity, difficult tenants, and cyclicality of the real estate and rental market.

Ways For Teens To Make Money and Save $10k

Saving 10k is not just limited to adults. There are many ways for teenagers to save $10,000 during the summer or school year. Kids as young as 14 years old can start making money.

Let’s do some math!

Most summer breaks are from early June until mid-August which is about 10-11 weeks. If a kid gets a job that pays $15 an hour and works 40 hours over 11 weeks, they’ll make $6,600. All you need to do is work an average of 6 hours a week for the remainder of the year to save $10,000 in 52 weeks.

Here are some of the best ways to make money as a teenager:

- Make money fast as a kid – babysit, walk dogs, wash cars, do yard work, and more.

- Grocery stores that hire at 14, 15, and 16 years old – you can easily find a couple of dozen national supermarkets that hire teens and offer flexible schedules.

- Online jobs for 13-year-old – Design t-shirts, tutor, start a blog, sell handmade crafts, etc.

- Places that hire at 14 and 15 years old – National chains hire teens, including grocery stores, restaurants, movie theatres, and other businesses.

- Restaurants that hire at 14, 15, and 16 years old – You’ll recognize most of the restaurants that hire teens such as McDonald’s, Dairy Queen, Culvers, and many more.

- Bussing tables at a restaurant – It’s an easy way to get your first job in a restaurant.

- Best jobs for extroverts – Great part-time jobs for extroverts who are outgoing and want interaction include tutor, tour guide, sales, etc

- Best jobs where introverts can work along at home or outside – Good part-time jobs for introverts who want to work alone include graphic designers, software developers, warehouse workers, pet groomers, dog walkers, lifeguards, and delivery drivers.

- Best under the table jobs that pay cash – The best part-time jobs that pay cash include walking a dog, tutoring, house cleaner, snow removal, lawn cutting, and babysitting.

Making money as a teen teaches money management, time prioritization, and people skills.

How Much Do Minors Get Taxed on $10k?

Age is not a factor when deciding whether you owe income tax or not. The IRS only cares if you earned income. The standard deduction for federal taxes was last raised to $12,400.

A teen earning less than $12,400 does not owe taxes. For example, a kid who makes $10,000 in a calendar year will not owe taxes, and likely won’t have to file an income tax return. Of course, you’ll want to file a tax return if you’re owed a refund. See the IRS website or a CPA for details.

How To Save 10k Summary

Personal finance is personal and emotional for everyone. First, you must decide if you want to save 10k in a year. There’s no reason to move forward until you’re on board.

Then go line by line and figure out where to start cutting monthly household expenses. Stop eating out? Will you call all your utility companies and negotiate a lower bill? Can you find a profitable side hustle and start making money fast?

TE PUEDE INTERESAR