Credit unions, banks, and other financial institutions in the US use routing numbers to identify themselves. That makes routing numbers essential in the banking sector. They facilitate the smooth transfer of funds and processing of checks by identifying the financial institution where money is coming from or going to. If you use the wrong routing number, your funds will go to the wrong place.

It’s just like your physical address. When you purchase a TV online at Walmart, you must give the correct physical address that identifies your location to deliver your package safely. If you give the wrong address, your item will be shipped to the wrong place. That’s exactly how routing numbers work. You must use the correct routing number that identifies your banking institution to send your money to the right place.

So if you are a member of the NFCU, you must know the correct Navy Federal Credit Union routing number because you will need it at some point to initiate or complete banking transactions.

For instance, the ACH network or the Automated Clearing Houses use routing numbers to process domestic electronic transfers. At the same time, the Federal Reserve Banks need your routing number to process domestic and international wire transfers.

So, you’ll need to provide the institutions with the correct routing number to facilitate payments and money transfers.

The big question is: What is the Navy Federal identification code?

Lee TambiénHow To Make Automotive Audio system Louder With out Amp?Short Answers: The Navy Federal Credit Union routing number is 256074974. While larger banks like Wells Fargo use multiple routing numbers in different states, the Navy Federal credit union uses only one transit number across all its branches. You’ll need your Navy Federal ABA number on several occasions to facilitate bank transactions, including:

- Sending or receiving ACH transfers

- Setting up automatic bill payments and direct deposits

- Making domestic and international wire transfers

- Receiving tax refunds.

About Navy Federal

Established in 1933, Navy Federal is a credit union that serves military employees, veterans, and families. It’s headquartered in Vienna, Virginia, and ranks as the largest natural-person credit union with over 10 million members.

Navy Federal Credit Union has about 343 physical branches across the US and nearly 30,000 ATMs that dispense $50 in its network to serve its members effectively. Members benefit from low-cost loans & credit cards, checking & savings services, debit/credit cards with chips, and other banking services like retirement savings, education savings, prepaid and gift cards, certificates, and money market accounts.

Luckily, there’s only one NFCU routing number that facilitates all financial transactions across its branches. So just remember that one number, and you are good to go.

What Is A Routing Number?

Lee También How To Discover My Husbands Iphone?

How To Discover My Husbands Iphone?A routing number is a nine-digit numerical code used to identify banks, credit unions, and other financial institutions in the US. It was created by the American Bankers Associations (ABA) to facilitate the smooth processing of paper checks and electronic transfer of funds between banks. Routing numbers are also called check routing numbers, ABA RTN, ABA numbers, or transit numbers.

Each financial institution has a unique routing number. Large banks have multiple routing numbers for the different states they operate in, while smaller banks and online-only banks use only one routing number across all their branches. For instance, there are about 24 Chase routing numbers, while the Navy Federal Credit Union has only one routing number.

Say you want to send money between two banks. The routing numbers help identify the financial institution where the money is coming from as well as the bank to where the money is being sent to. Therefore, you must use the correct NFCU routing number when sending or receiving ACH and wire transfers so that your money ends in the right place.

Your routing number will be based on the state where you first opened your account for banks like Chase, PNC, or Wells Fargo, with multiple routing numbers for domestic and wire transfers.

What Are Routing Numbers Used For?

Every bank transaction has two essential parts: the routing number and the account number. The routing number identifies the financial institution where you are the customer, while the account number identifies you as a customer. That’s why your account number is unique and cannot be shared with any other customer. It’s the same for the banks. Each bank has a unique routing number that any other bank cannot use.

Lee También What’s the Wells Fargo Notary Service Charge? Make Notary Appointment?

What’s the Wells Fargo Notary Service Charge? Make Notary Appointment?Since each bank has a unique identifier, financial transactions can be processed between banks without any confusion.

Here’s a list of financial transactions that require you to pair your NFCU routing number with your account number:

- Sending and receiving domestic and international transfers

- Setting up automatic bill payments and direct deposits

- Receiving payments like tax refunds, salary, and pension into your NFCU account

- Linking your bank account to a financial app

- Transferring money between accounts in different banks or investment firms

- Making ACH payments within the US

For instance, let’s say you want to buy income-producing assets. You’ll require your Navy Federal Credit Union routing number to transfer money between accounts. You may also require someone to send you a wire transfer to book a hotel room without a credit card. Again, you’ll need to supply the sender with your NFCU routing number and account number to get the money.

Is the Access Number and Account Number the Same?

No, your Navy Federal access number is not the same as the account number. Your account number identifies you as a customer in the credit union, while your access number is a unique member identifier assigned when opening the account. The access number can be used to login in online and view all of your accounts. It’s only used to authenticate the user during login.

How Many Digits is Navy Federal Credit Union Account Number?

Lee También ¿Es posible transferir dinero de una tarjeta EDD a una cuenta corriente? Por supuesto

¿Es posible transferir dinero de una tarjeta EDD a una cuenta corriente? Por supuestoDon’t confuse an account number with the routing number. The Navy Fed account number is ten digits long, while the routing number consists of 9 digits. You’ll find both the NFCU routing number and your account number printed on the MICR line at the bottom of the check issued at your Navy Fed branch.

However, other banks like Chase have account numbers that are nine digits long, just like the routing number.

How To Find a Bank Routing Number for Navy Federal Credit Union?

As we have already seen, the Navy Federal credit union has only one routing number. Therefore, the ABA routing number 256074974 is used across all the different locations Navy Fed Credit Union has operations.

Smaller banks like Navy Federal credit union have only one routing number because they haven’t made any acquisitions or mergers with other financial institutions. As the credit union grows in the future, it may get to a point where it has more than one routing number. But as of now, you only need to remember the one above.

Just copy and save the Navy Federal routing number 256074974. The same number is used for domestic ACH and wire transfers.

Lee También ¿Acepta CVS Google Pay y Samsung Pay? Información completa

¿Acepta CVS Google Pay y Samsung Pay? Información completaThere are other ways to find your Navy Federal credit union routing number, including:

- Navy routing number at the bottom-left corner of your check

- NFCU routing number on the statement

- Viewing your routing number on the NFCU app

- Calling NFCU customer service

- Search on the Federal Reserve Bank’s Directory

How To Find Bank Routing Number for Navy Federal on Check

Your first option is to find your Navy Federal routing number on the check. Most banks and credit unions issue at least one free checkbook as a perk for account holders. Even if you are a new customer, you should have at least one checkbook.

You’ll find your NFCU routing number, 256074974, printed at the bottom of the personal checks issued by your credit union branch.

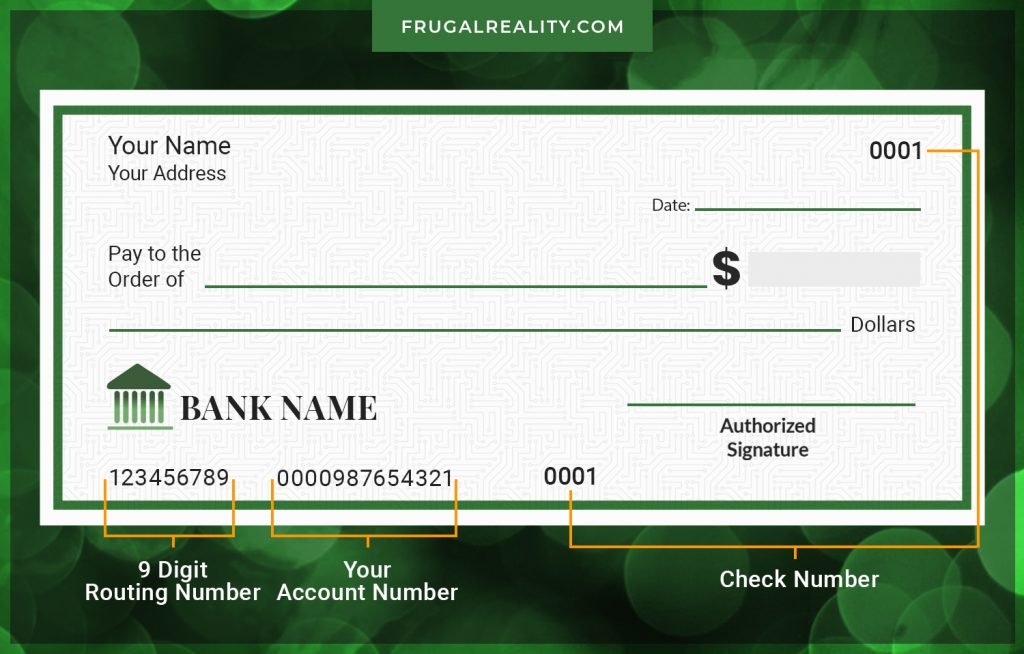

To find your Navy Federal ABA number on the check, locate the MICR line at the bottom of the check. Along the MICR line, you’ll find three sets of numbers printed from left to right. They include your routing number, your account number, and the check number.

So, what number is the routing number on the check? The screenshot below shows where to find a routing number on a physical check.

Lee También 25 Concesionarios que pagan una congruencia desfavorable cerca de mí

25 Concesionarios que pagan una congruencia desfavorable cerca de mí

Your Navy Federal routing number is the first group of nine digits printed on the bottom-left corner of your personal check. The next group of ten numbers at the bottom center is your account number. Then, at the bottom-right, you’ll find another set of 4-digit numbers. That’s your check number and is vital for helping you keep track of your check payments.

Both the routing number and the account number are issued at the time of opening the account. Banks with multiple routing numbers are based on the state where you first opened your account.

But you don’t have to remember where you opened your account for online-only banks and credit unions that use one routing number across all of their branches. The number will help you facilitate all your transactions.

Can I Find My Navy Federal Routing Number on my Monthly Statement?

If you don’t have a check, you can easily find your Navy Federal routing number on monthly statements issued from your Navy Federal branch. Simply check any monthly statements you have from the credit union, and you’ll see the routing number and bank account printed at the top of the statement.

If you still can’t figure out which number on the check or statement is the routing number, cross-check the one corresponding to the Navy Federal Credit Union routing number 256074974. That’s the routing number you should use.

If you don’t have a check and already trashed all your monthly statements, don’t panic. Digital alternatives exist to help you locate your NFCU routing number hassle-free. Keep reading to discover more ways to find your ABA number.

How To Find Your Federal Navy Routing Number Online?

Finding your Navy Federal routing number online is a good option if you don’t have a check or bank statement. You’ll first need to enroll in online banking at the Navy Federal credit union. Once you have your account online, finding your Navy Federal direct deposit routing number online is easy.

You’ll find your NFCU routing number online by visiting NavyFederal.org. First, log into your NFCU online account using your username and password. If you don’t have an online account, click the “Enroll in Digital Banking” button to sign up. From there, you should be able to see all your recent monthly statements and other account details like your routing number and account number.

If you can’t readily see the number, open any monthly statement and check at the top or try searching for “routing number” in the page’s search bar inside your account.

The Federal Reserve banks’ E-payment directory is also a good option to search for your transit number. It allows you to search by state or city, or you can also use the routing number to find a financial institution’s name.

How To Get Routing Number on the Navy Federal App?

Checking online can be tedious for low-income earners who haven’t been beneficiaries of free government internet and laptop for low-income families. Luckily, mobile banking has made it easier than ever before to access banking details on the go with little data usage.

While using your smartphone, you can view your Federal routing number on the Navy Federal banking app. You only need to download and install the app on your smartphone by finding a nearby 24-hour store with free Wi-Fi.

Once the app is installed, view your NFCU routing number on the app as follows:

- Sign in to your account via the NFCU mobile app

- Tap on your bank account

- Press on “Show More Details”

- From there, you should be able to locate your routing number and account number.

What Happens If I Change Banks?

If you decide to switch banks, you will need to provide your new bank with your old bank’s routing number and account number. This will allow your new bank to process any outstanding transactions that were initiated when you were still a customer at your old bank.

Additionally, your direct deposits and automatic payments will be temporarily suspended until you re-establish them with your new bank.

How Do You Contact Navy Federal For Your Routing or Wire Number?

If you need human confirmation, consider calling your NFCU branch to inquire about the correct number to use. Contact the NFCU customer representative via 1-888-842-6328 and ask them the correct Navy Federal ABA routing number you should use for ACH or wire transfers.

For your security, you’ll need to answer a few questions to confirm your identity. So have your account and related financial documents on hand when you call to prove you’re not an imposter.

Do Routing Numbers Change?

Routing numbers may occasionally change due to mergers or acquisitions between banks. In such cases, the acquiring bank will take on the routing number of the acquired bank.

Your account number will remain unchanged. You can find out if your bank’s routing number has changed by contacting customer service or checking your financial institution’s website.

What is the Navy Federal Domestic Wire Routing Number?

The Navy Federal domestic wire routing number is 256074974. Other financial institutions like Chase, Wells Fargo, and PNC use ABA routing numbers for ACH transfers. However, they use a different routing number for domestic wire transfers and a swift code for international transfers when receiving or sending wire transfers.

Things are different at the Navy Federal credit union. The same ABA routing number 256074974 is used for domestic ACH and wire transfers inside the United States. It’s a straightforward system.

Though the routing number is the same for ACH and wire transfers, the two differ in the following ways:

- Wire transfers clear faster: Wire transfers are processed faster than ACH transfers. As a result, money is available for the recipient to withdraw within a few minutes or hours.

- Wire transfers are more secure: Wire transfers take place directly between banks. Each bank confirms the transaction before it clears. Third-party clearinghouses handle ACH transfers, and funds are cleared automatically.

The convenience of wire transfer comes at a fee. Unlike ACH transfers that are free, NFCU assesses a fee of between $14 and $25 to send and receive wire transfers. Since wire transfers aren’t free, you need to carefully weigh your options and the cost when deciding between ACH and wire transfers.

You can drastically cut expenses using ACH transfers for your everyday non-urgent transactions and use wire transfers only for urgent or emergency transactions.

What are the Navy Federal Wire Transfer Fees?

Navy Federal wire transfer fees depend on whether you are sending or receiving wire funds inside the US or internationally. The wire transfer fees cost $14 when sending or receiving wire transfers within the US. Domestic wire transfers clear within 1-2 business days.

What Information is Needed for a Wire Transfer at Navy Federal Credit Union?

Most financial institutions require similar information for domestic wire transfers. For example, here’s the required information to send a wire transfer at Navy Federal:

- Your Info – Name, senders address if over $3,000, and your account number

- Payee Info – Recipient’s name, address if over $3,000, their account type, and account number

- Recipient’s Institution Info – Name, address, and ABA/routing number

- Transfer Info – Transfer dollar amount, additional wiring instructions if necessary

What’s the Federal Navy International Wire Transfer Routing Number?

An intermediary bank usually provides the Federal Navy international wire transfer routing number. While other financial institutions may use a SWIFT code for international and domestic wire transfers, NFCU uses the same ABA routing number for domestic ACH and wire transfers within the US. Therefore, cross-border wire transfers aren’t sent directly to or from NFCU but through an intermediary bank.

So when sending or receiving an international wire transfer to a Navy Federal account in the USA, you’ll use the same 256074974 routing number.

It’s because NFCU wire transfers go through an intermediary bank where the money is forwarded to the final recipient. In this case, the SWIFT code is provided by the sender’s bank. So to ensure a smooth transfer check the transfer instructions with your recipient to make sure all the information is correct.

What are the Navy Federal International Wire Transfer Fees?

Navy Federal international wire transfer fees depend on whether you are receiving or sending a wire transfer, but mostly, the fee is $25. You can wire funds overseas in foreign currency in US dollars.

NFCU international wire transfers clear within 5-7 business days. To expedite the process and avoid delays, coordinate with the payee to ensure that their bank’s wiring details are correct.

How Long Does A Wire Transfer Take Navy Federal?

The length of time a wire transfer takes at Navy Federal credit union depends on whether you are sending domestic or international wire transfers. A wire transfer takes place directly between banks and doesn’t require bank account holds. In most cases, wire funds will be available for the recipient to withdraw within a few minutes or hours after the transaction clears.

That said, domestic wire transfers take Navy Federal 1-2 business days, while international transfers may take anywhere between 5-7 business days to clear. But, again, it’s probably because NFCU international wire transfers go through an intermediary bank.

Cut-off times for wire transfers, holidays, and weekends may also affect whether the transfer is initiated on the same day or the following day. Individual banks set their own cut-off transfer times and deposit times.

Contact your NFCU branch to inquire about their cut-off transfer time when sending urgent wire funds.

Wire Transfer Fraud: What to Look For When Moving Money

When transferring money, it’s important to be aware of the risks of wire transfer fraud. These scams can occur when someone attempts to hack into your account or when you’re dealing with a fraudulent third party. By knowing what to look for, you can reduce the chances of falling into this trap.

Some common signs of wire transfer fraud include:

- Request for personal information: Be careful about giving out your personal information online. Scammers may try to get this data to steal your identity or access your account.

- Unusual payment methods: Be suspicious of any request to wire money using a cash transfer method that’s unusual for you. This could be a sign that the person is trying to scam you.

- Unexpected requests for money: If someone suspiciously asks you to wire them money and you’re not expecting the request, it’s likely a scam. This is especially true if the person doesn’t have a good reason for why they need the money.

- Sudden changes in communication: If the person you’re communicating with suddenly changes their story or starts asking for more money, it’s likely a scam. Be especially careful if the person is trying to rush you into making a decision.

- Demands for secrecy: If the person asks you not to tell anyone about the transaction, it’s likely a scam. This is a common tactic used by scammers to prevent you from getting help.

- Unreliable contact information: Be careful if the contact information provided by the person seems unreliable. This could be a sign that they’re trying to scam you.

- Grammatical errors: Be suspicious of any emails or messages that have grammatical errors. This could be a sign that the person is not who they say they are.

- Fake invoices or bills: Be careful of any invoices or bills that arrive in your mailbox out of the blue as they may be fake. If you’re ever contacted about a wire transfer and you’re not sure if it’s safe, don’t hesitate to reach out to your bank for help. They can verify the legitimacy of the transaction and help you protect your account.

If you come across any of these signs, it’s important to exercise caution. You may want to speak with someone you trust about the situation before making any decisions.

It’s also a good idea to keep your computer protected with antivirus software and to be careful about what websites you visit. By being vigilant, you can protect yourself from wire transfer fraud.

How Can I Join the Navy Federal Without Being in the Military?

Since NFCU specifically provides financial services to the military, veterans, and their families, many people are left wondering: Can I join Navy Federal without being in the military and take advantage of the low-cost financial services?

Yes, it’s possible to join Navy Federal without being in the military. Civilians join Navy Federal Credit Union if they are immediate family members or household members of an eligible Navy Fed member. Eligible civilians can either be children, grandchildren, spouses, siblings, parents, or grandparents of an eligible Navy Federal member.

Since you’ll be joining as a non-military member, an eligible Navy Fed member must provide their last name, Access Number, and affiliation to sponsor your membership before you can sign up.

How To Open a New Account at Navy Federal?

Opening a new account at Navy Federal is simple if you are in the military or meet the eligibility criteria above. Simply visit your nearest NFCU branch to apply for membership. Alternatively, you can sign up for a new NFCU account online or by phone at 1-888-842-6328.

Navy Federal Routing Number Summary

That’s how simple it’s to get your Navy Federal routing number. And the good thing is, there’s only one Navy Federal routing number, 256074974, used for domestic ACH and wire transfers within the US. You can also find your NFCU routing number printed on the check or any monthly statement issued by your NFCU branch.

Alternatively, check online via the website, the NFCU app, or contact the Navy Federal customer service and ask a representative to provide the correct ABA number. When sending or receiving the NFCU wire transfers internationally, the SWIFT code is provided by the sender’s or intermediary bank processing the transaction.

TE PUEDE INTERESAR