Routing numbers form the core of all financial transactions. They facilitate electronic transfers and the processing of checks between banks, credit unions, and other financial institutions. Just like your physical address that identifies where you live, banks in the US use routing numbers to identify themselves. As such, a bank’s routing number helps identify the bank where funds are coming from or going to when sending and receiving money between financial institutions.

For example, Automated Clearing Houses, famously known as the ACH network, use routing numbers to process electronic transfers like bill payments, direct deposits, or tax refunds. Again, the Federal Reserve banks need routing numbers to process domestic and international wire transfers.

Why would you want to know your Chase bank routing number? Isn’t that your bank’s business?

Short Answer: If you are a Chase customer, there are several occasions you’ll need to pair your bank routing number with your account number to initiate or complete financial transactions. A few to transfer money include:

- Bill payments and setting up direct deposits

- Receiving tax refunds

- Making domestic and international wire transfers

- Sending or receiving ACH transfers

All these transactions require you to know and use the correct JP Morgan Chase ACH routing number. Otherwise, your money may end up in the wrong place. Mistakes in fund transfers can result in unwanted costs and delays.

About Chase Bank

Lee También 36 Southwest Airlines Tips and Tricks (Promos Codes and Discount Deals) 2021

36 Southwest Airlines Tips and Tricks (Promos Codes and Discount Deals) 2021Headquartered in Manhattan, New York City, Chase is one of the big four banks in the US. According to Chase, the bank proudly serves nearly half the households in the US with a broad range of financial services, including small business loans, personal banking, mortgages, payment processing, auto financing, credit/debit cards with chips, and investment advice for the best income producing assets.

To serve its customer base effectively, Chase has over 4,700 branch locations and about 16,000 ATMs that dispense $10. In fact, many Chase ATMs let you withdraw bills of $1, $5, $10, and $100.

The Chase bank routing numbers direct all financial transactions at Chase. With so many branches across the US and beyond, JP Morgan Chase ACH routing numbers vary by state. Thus, you should know your correct Chase routing number to ensure stress-free ACH and Fedwire transfers.

- What Is A Routing Number?

- What Are Routing Numbers Used For?

- What is a Wire Transfer?

- Domestic and International Wire Transfers

- How Do Wire Transfers Work?

- How Much Time Do Wire Transfers Take?

- How Many Digits is Chase Account Number?

- Why Does Chase Have Different Routing Numbers?

- How To Find a Bank Routing Number for Chase?

- How To Find Bank Routing Number for Chase on Check

- Can I Find My Chase Routing Number on my Monthly Statement?

- How To Find Your Chase Routing Number Online?

- How To Get Routing Number on Chase App?

- How Do You Contact Chase For Your Routing or Wire Number?

- What is the Chase Domestic Wire Routing Number?

- What are the Chase Bank Wire Transfer Fees?

- What’s the Chase International Wire Transfer Routing Number?

- What are the Chase International Wire Transfer Fees?

- What Information is Needed For a Wire Transfer at Chase?

- What Can Someone Do With Your Bank Account and Routing Number?

- How Long Does A Wire Transfer Take Chase?

- How To Find My Chase Liquid Account Number?

- Which Chase Routing Number Should You Use?

- Chase Routing Number Summary

What Is A Routing Number?

A routing number is a nine-digit code used to identify banks, credit unions, and other financial institutions in the US. Created by the American Bankers Association, routing numbers are meant to facilitate paper checks and securely send and receive money electronically between financial institutions.

Each bank has its own unique routing numbers. For instance, Chase bank routing numbers are different from Wells Fargo’s routing numbers. When transferring money between two banks, or bank branches, routing numbers help identify which bank your money is being sent to or the bank where transfers into your account have been received from.

There’s no difference between the ABA number and routing number. ABA number, check routing number, ABA routing transit number, and ABA RTN are all terms used to refer to bank routing numbers.

Lee También ¿Dónde comprar tarjetas regalo de Victoria's Secret? ¡Cerca de aquí!

¿Dónde comprar tarjetas regalo de Victoria's Secret? ¡Cerca de aquí!While smaller banks or online-only banks may have just one routing number, large banks like Chase have multiple routing numbers that vary from state to state where the bank operates. Due to many routing numbers, it’s possible to confuse your routing number, especially if you have moved between states.

It’s vital to ensure that you use the correct routing number before initiating any ACH or wire transfers. Your JPMorgan Chase routing number is unique to the area or state where you first opened your bank account.

What Are Routing Numbers Used For?

Why do you need a routing number? Well, the routing number forms the basis of all financial transfers between banks. You’ll need to know your chase routing number when sending or receiving ACH and Fedwire transfers.

Here’s a list of financial transactions that require your Chase bank routing number:

- Setting up direct deposits and automatic bill payment

- Sending and receiving domestic and international transfers

- Linking your Chase bank account to a financial app

- Receiving payments like salary, pension, and tax refunds into your chase bank account

- Making ACH payments within the US.

- Transferring money between accounts in different banks or investment firms

A good example of ACH payments within the US is paying for purchases with a check or book a hotel room without a credit card. Rebalancing accounts, rolling over 401ks, paying for business transactions, and buying income-producing assets are also good examples of money transfers that will require your Chase bank routing number.

What is a Wire Transfer?

A wire transfer is the process of transferring money between two banks through electronic means. Traditionally, a wire transfer of money goes from the first bank to the second through different networks.

Lee También Can You Overdraft Cash App Card? Fix Cash App Negative Balance

Can You Overdraft Cash App Card? Fix Cash App Negative BalanceAccordingly, the cost of transferring money would vary from one bank to another. Wire transfer happens to be one of the fastest means of transferring funds when it comes to exchanging money in quick time.

Moreover, the process is generally safe and reliable. People rely on wire transfer primarily because of its reliability and speed.

Again, wire transfer would be your only option of money transfer when the amount to be transferred is pretty substantial. Regardless of the amount involved, the recipient receives the fund almost immediately.

For example, people purchasing a property often settle transactions with their agents using wire transfers.

Domestic and International Wire Transfers

Keep in mind that a wire transfer can imply any kind of money transfer through electronic means. However, bank wire transfers imply domestic or traditional transfers of money between banks.

US consumers also wire funds to people overseas. International wire transfer services are also available for transfer of funds. These are referred to as remittance transfers.

Lee También 9 formas de resolver: el error de la aplicación Cash no puede vincular la tarjeta en este momento

9 formas de resolver: el error de la aplicación Cash no puede vincular la tarjeta en este momentoIn addition to Chase, there are other financial service companies and credit unions that provide money transfer services. Note that this type of transaction is also known as money wiring.

How Do Wire Transfers Work?

Get in touch with your bank to initiate a wire transfer. They’ll request certain information regarding where you wish to dispatch the funds.

Accordingly, you may be asked to furnish relevant details about the following:

- The name of the recipient

- The bank account from where the money will come

- Bank account number of the recipient

- Zip code and postal address of the recipient

- Name of the bank where you want to send the funds

- The ABA routing number of the bank

How Much Time Do Wire Transfers Take?

For domestic wire transfers, the amount reaches the recipient’s bank account on the same day most of the time. A sender can only dispatch funds that are already in their respective bank accounts.

Therefore, the recipient’s bank doesn’t have to wait for them to get cleared. So, the recipient will receive the money right away.

Many people in the US and other countries use wire transfers owing to the safety that tags along with them. However, each party that wants to send funds through wire transfer would require a bank account.

Lee También How to Sell on Poshmark Fast – 2022 Tips & Fees Guide

How to Sell on Poshmark Fast – 2022 Tips & Fees GuideAs per federal regulations, the banks need to verify the account holder’s identity prior to opening an account. At times, the bank would also request you for a physical address, where they can contact you.

Wire transfers are immune to scams, as thieves find it difficult to seep into the mechanism. However, transactions made through PayPal or personal checks might involve scams. Considering this safety barrier. It’d be wise to make wire transfers through an adept provider like Chase, particularly when the amount is large.

How Many Digits is Chase Account Number?

A Chase bank account has nine digits which is the same number as a routing number. You’ll find both the routing number and account number printed on the MICR line at the bottom of the checks issued at your bank branch.

However, Chase credit cards use a 16 digits account number which serves the same purpose as the bank’s routing number and account number rolled into one.

What are the Chase Routing Numbers by State?

Chase has many routing numbers because of its numerous acquisitions in the past. You’ll notice in the table below that the ABA routing number 322271627 is used in several states, including Chase California, Oregon, Washington.

Lee También ¿Cómo donar gafas graduadas en Costco? Papelera de reciclaje cerca de mí

¿Cómo donar gafas graduadas en Costco? Papelera de reciclaje cerca de mí| State | Routing Number |

| Chase Arizona | 122100024 |

| Chase California | 322271627 |

| Chase Colorado | 102001017 |

| Chase Connecticut | 21100361 |

| Chase Florida | 267084131 |

| Chase Georgia | 61092387 |

| Chase Idaho | 123271978 |

| Chase Illinois | 71000013 |

| Chase Indiana | 74000010 |

| Chase Kentucky | 83000137 |

| Chase Louisiana | 65400137 |

| Chase Michigan | 72000326 |

| Chase Nevada | 322271627 |

| Chase New Jersey | 21202337 |

| Chase New York – Downstate | 21000021 |

| Chase New York – Upstate | 22300173 |

| Chase Ohio | 44000037 |

| Chase Oklahoma | 103000648 |

| Chase Oregon | 325070760 |

| Chase Texas | 111000614 |

| Chase Utah | 124001545 |

| Chase Washington | 325070760 |

| Chase West Virginia | 51900366 |

| Chase Wisconsin | 75000019 |

Why Does Chase Have Different Routing Numbers?

Smaller banks or online-only banks have only one routing number. But large banks like Chase, Wells Fargo, and others have multiple routing numbers that may vary from state to state. For instance, Chase bank has a whopping 24 different routing numbers across the different states.

The reason why large banks, like Chase, have different routing numbers is that they merge and acquire other financial institutions over the years as they grow. As mentioned earlier, Chase has over 4,700 branches and over 16,000 ATMs across the US. Chase bank merged and acquired financial institutions like JP Morgan & Co, Manhattan Company, Bank One Corporation, and Washington Mutual to grow into one of the largest banks in the world.

The financial institutions had their own financial infrastructure in place at the time of the merger or acquisition, including routing numbers. Instead of overhauling everything, each merger or acquisition is added on top of the existing Chase infrastructure. That’s how Chase ended up with different routing numbers.

For the same reason, you’ll find some states using similar Chase routing numbers. For instance, you’ll notice from the table above that states like Wyoming, Washington, DC, Virginia, South Dakota, Ohio, Oklahoma, New Mexico, Montana, Maryland, Arkansas, among others, share the same routing number: 044000037

It was likely one bank acquired by Chase that had operations in those states. It means you can easily find out Chase’s mergers and acquisitions by tracing them back to their routing numbers.

Banks that acquired many small financial institutions in the same areas have a more complicated ABA routing number system.

How To Find a Bank Routing Number for Chase?

Your routing number is unique to the state where you first opened your account. For instance, the Chase bank routing number for Illinois state is 071000013.

Try finding your Chase routing number in our table above. If you can’t remember the state where your account is based, there are other ways to find your Chase routing number, including:

- Chase routing number at the bottom-left corner of your check

- Find Chase account number and routing number on the statement

- View routing number on Chase app

- Calling Chase customer service

- Search on the Federal Reserve Bank’s Directory

How To Find Bank Routing Number for Chase on Check

Your first option is to find your Chase bank routing number on the check. If you are a new account holder, most banks will issue at least one free checkbook. You’ll find the Chase account number and ABA routing number printed at the bottom of the personal checks issued by your Chase bank branch.

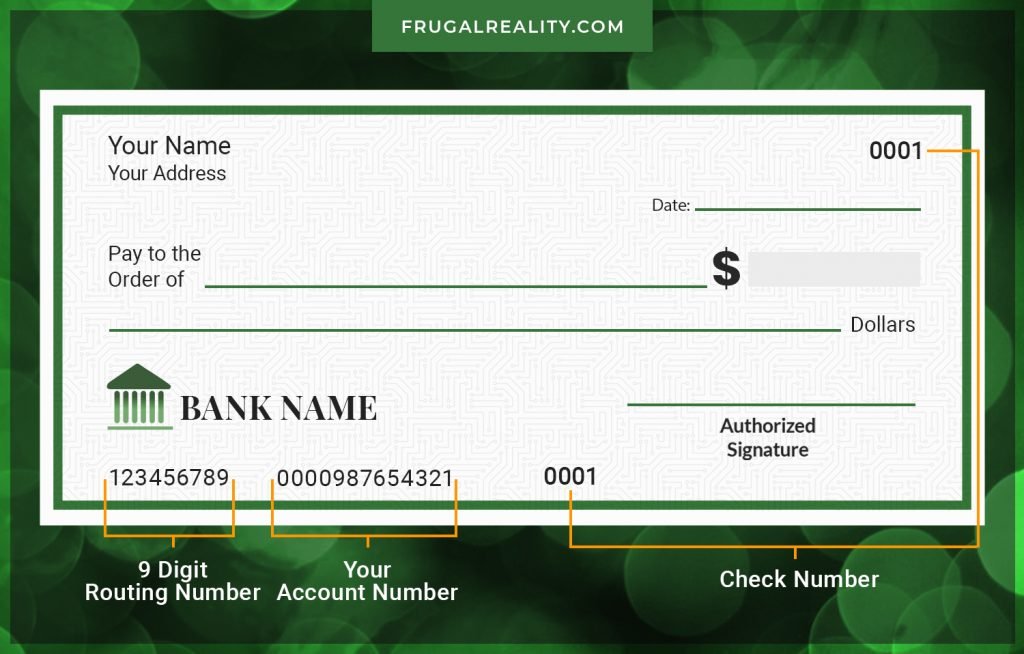

To find your Chase bank routing number on a check, locate the MICR line at the bottom of the check.

You’ll see three groups of numbers printed along the MICR line, including the routing number, your account number, and the check number.

What number is the routing number on a check? The screenshot below shows what part of the check is the routing number.

Notice the first group of nine digits printed on the bottom-left corner of your Chase Bank check is the routing number. The next set of numbers at the bottom center is your account number. The last 4-digit number at the bottom-right corner is your check number which helps you keep tabs on your check payments.

Both your Chase routing number and account number are issued at the Chase branch where you opened your account. Always remember that your routing number is tied to the state where you opened your account and not where you are currently living.

Let’s say I move from Illinois to Maryland, whose routing number is 044000037. Since I opened my account in Illinois, I’ll still use the Illinois routing number 071000013 because that’s where my account is permanently based.

Can I Find My Chase Routing Number on my Monthly Statement?

Yes, you can find your Chase routing number and your account number printed on any monthly statements issued by your bank branch.

That’s how easy it is to find a Chase routing number on a check or bank statement. If you still find it a hassle figuring out which part of the check is the routing number, cross-check with our table above to establish which state corresponds to the same number printed on your check. Otherwise, keep reading to discover other ways you can use to find your Chase routing number.

How To Find Your Chase Routing Number Online?

If you don’t have a personal check from Chase bank, you may opt to find your Chase routing number online. But how do you find your Chase direct deposit routing number online?

To find your Chase online routing number, you need to be enrolled in online banking.

Follow these steps to find your Chase account number and routing number on Chase.com:

- Sign-In: Use your laptop, desktop, tablet, or smartphone to sign in to your Chase online account. If you don’t have an online banking account with Chase, hit the “Enroll” button to create one.

- See Statements: Once you log in, tap on “see statements” to see all your recent monthly statements.

- Open Statement: Click on any statement to open it as a PDF

- Top-Right of First Page: Look at the top-right corner of the first page. You should see your Chase routing number along with your bank account printed there.

- Limited View: For your safety and security, the last four digits of your account number will be slashed.

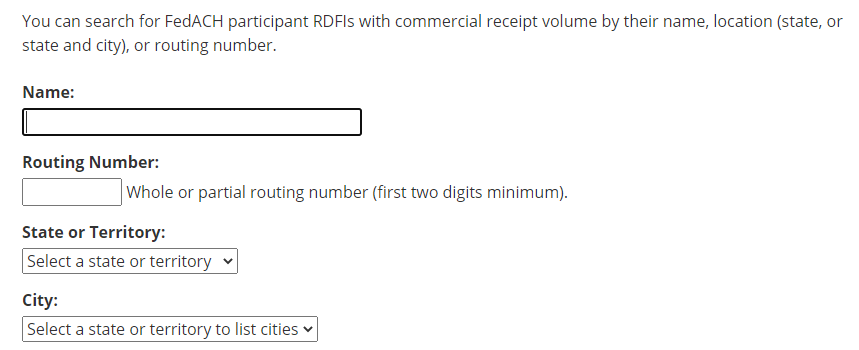

Also, the Federal Reserve banks’ E-payment directory maintains a database of ACH routing numbers for all banks. You can search their database for your Chase routing number by bank name or state. Again, you can use the routing number to find a financial Institution’s name, as shown on the screenshot below.

To avoid the hassles of looking online all the time, you can save the routing number on your phone or print it out and keep it somewhere safe for future references.

How To Get Routing Number on Chase App?

Not everyone has been a beneficiary of free government internet and laptop for low-income families, and checking online can be tedious. Thanks to mobile banking, you can access banking info on the go with little data usage. If you don’t get free unlimited internet or low-cost internet at home, you can view your account number on the Chase app along with the routing number on Wi-Fi at a nearby 24-hour store.

First, download and install the Chase app on your smartphone. Once you have it, follow the steps to view your routing number on the Chase mobile app:

- Sign in to your account via Chase’s mobile app to access your account.

- Tap on your bank account.

- Press on “Show More Details.”

- Locate the routing numbers

That’s it! It’s easy to find your account number, Chase routing number, and Chase SWIFT code through the app.

How Do You Contact Chase For Your Routing or Wire Number?

Consider calling your Chase branch if you can’t remember where you first opened your account or have any doubts about the correct Chase routing number to use. It’s crucial to call and confirm rather than having your money go to the wrong bank or account.

Contact a Chase customer service representative for your ABA routing number via 800-935-9935.

Have the details of your account on hand before you call. You’ll be required to answer a few security questions to verify your identity.

What is the Chase Domestic Wire Routing Number?

ABA routing numbers are only used for ACH transfers. When sending or receiving domestic and international wire transfers, you’ll use a different Chase routing number for domestic transfers and a SWIFT code for international wire transfers.

The Chase domestic wire routing number is 021000021. You can copy and save it directly from here, or if in doubt, use any of the methods above to find the Chase routing number for domestic transfers inside the United States.

Knowing the Chase domestic wire routing number is handy if you want to send funds urgently. Domestic wire transfers differ from ACH transfers in a few ways:

- Wire transfers clear faster: Wire transfers clear faster than ACH transfers. Funds can be made available within minutes or just in a few hours.

- Wire transfers have a more straightforward routing number system: ACH transfers use different ABA routing numbers in different states. There are only two Chase wire transfer routing numbers: a Chase domestic wire routing number and a Chase international SWIFT code.

- Wire transfers are more secure: ACH transfers are handled by third-party clearinghouses where transactions clear automatically. Wire transfers take place directly between banks; each bank confirms the transaction before it clears.

However, the convenience of wire transfers doesn’t come for free. Chase bank assesses wire transfer fees between $15 and $50 to send and receive wire transfers. On the other hand, ACH transfers are free. The added cost of wire transfers is huge for a frugal consumer trying to drastically cut expenses and save money. Navigate the cost by using wire transfers for urgent transactions only or when making a lump-sum purchase. Otherwise, ACH transfers will suffice your everyday non-urgent transactions.

What are the Chase Bank Wire Transfer Fees?

The Chase charge for a wire transfer depends on whether you send or receive wire funds inside the United States or cross-border.

Here’s an estimated price for Chase domestic wire transfer fees:

- Incoming (receiving) wires: $15

- Outgoing wires (online): $25

- Outgoing wires (in-branch): $35

What’s the Chase International Wire Transfer Routing Number?

The Chase international wire transfer SWIFT code is CHASUS33.

The Chase international wire transfer SWIFT code looks different from all the other routing numbers. It’s because SWIFT codes are used to identify financial institutions globally while routing numbers identify banks domestically.

When sending or receiving wire transfers internationally, use the Chase SWIFT code instead of your Chase routing number. You should give this code to anyone who wants to deposit money into your Chase account from abroad.

You can copy and save the Chase international wire transfer SWIFT code shown above, view it online or in the Chase app. Otherwise, contact your bank directly to ask for the SWIFT code.

What are the Chase International Wire Transfer Fees?

Like the domestic fees, Chase international wire transfer fees depend on whether you are sending or receiving a wire transfer. Chase international wire transfer fees apply as follows:

- Incoming (receiving) wires: $15

- Outgoing wires (online): $40

- Outgoing wires (in-branch): $45/$50

There are some exceptions where chase wire transfer fees can be waived. For instance, online wire transfers of $5,000 or more sent to a bank outside the US in foreign currency have no Chase wire fees, including six figures and seven-figure transactions. Amounts less than $5,000 have only a $5 Chase wire fee.

Some premium Chase accounts have Chase wire transfer fees waived completely. A good example of this is the Chase Private Client account that doesn’t charge any wire fees for both domestic and international wire transfers.

The domestic and foreign Chase wire transfer fees aren’t static and do change over time. You must check the current fees before initiating wire transfers.

What Information is Needed For a Wire Transfer at Chase?

You need to supply your bank with more information to initiate or complete wire transfers.

Here’s all the information needed for a wire transfer at Chase:

- Sender’s government-issued identification

- Sender’s full name and contact information

- Sender’s bank account and transit number

- Recipient’s full name and contact information

- Recipient’s bank account information and transit number

- Recipient’s ABA routing number

You do not need to find a place to get a cheap notary nearby to do a wire transfer.

Always take the time to confirm with the recipient or your bank that you have provided the correct information before processing a wire transfer. The important financial details to confirm include the recipient’s account number, contact information, and the routing number or SWIFT code.

Getting the details wrong will have your funds go to the wrong recipient or financial institution. The resulting delays and costs of reversing and re-wiring the funds are unacceptable for a savvy consumer dedicated to achieving important financial goals like saving $10,000 a year.

It can even be more disastrous since Chase wire transfers are irrevocable in most cases. You may be unable to get your cash back. If you notice an error after processing a wire transfer, notify your bank immediately to initiate a cancellation, make the necessary adjustment, or inquire about the steps you should take to reverse your wire transfer.

What Can Someone Do With Your Bank Account and Routing Number?

Fraudsters use routing numbers and account numbers to target unsuspecting victims. For instance, scammers can use your Chase routing number and account number to transfer money from your account or pay bills without your consent. They can also order fake checks to pay for purchases, cash at liquor stores, or other check cashing places.

To beat fraudsters, avoid writing personal checks or giving your bank information online to unfamiliar individuals and businesses. Instead, you can opt to use gift cards, like activated American Express gift cards, to make purchases online. Alternatively, use your debit card without a pin by linking it to a secure online payment platform like PayPal to avoid giving your details to every online merchant.

Instead of writing checks, you can purchase money orders at Publix or Walmart and use them to pay suspicious merchants. Unlike checks, buying a money order doesn’t carry your bank details.

At least a consumer has protection when a thief uses a stolen credit card to their advantage.

How Long Does A Wire Transfer Take Chase?

How long wire transfers take at Chase depends on whether you are sending domestic or international wire transfers. Since wire transfers don’t require bank account holds, the funds are usually available for the recipient to withdraw immediately after the transfer is completed.

Domestic wire transfers clear within 1-2 business days, while cross-border Chase wire transfers may take 3-5 business days to process. That said, some factors such as cut-off times, weekends, holidays, and federal regulations may delay the wire transfer times.

Individual banks set cut-off transfer times. Contact your bank or credit union to confirm when your processing urgent wire funds. For instance, 4 pm EST is the cut-off time for sending Chase wire transfers.

How To Find My Chase Liquid Account Number?

The Chase Liquid card is a prepaid debit card offered by Chase Bank. You can find your Chase Liquid account number by directly calling a customer representative via 1-800-935-9935. Alternatively, find the account number online at Chase.com as follows:

- Logging in to your Chase.com account

- Navigate to the “Customer Center” tab.

- Hit the ” Set up direct deposit” link

Which Chase Routing Number Should You Use?

For any domestic money transfer activity

Use the ABA routing number of the state where you opened your Chase account from the list above.

For any domestic wire transfers

Use the Chase domestic wire transfer routing number 021000021.

For international wire transfers

Use the Chase SWIFT code CHASUS33.

Chase Routing Number Summary

Routing numbers are the core of ACH and wire transfers between financial institutions. Large banks like Chase have multiple ABA transit numbers that vary by state. Your Chase routing number is based on the state where you first opened your account. You’ll need your JP Morgan Chase ACH routing number to process ACH transfers, like setting automatic deposits and bill payments with your Chase account.

Chase ABA routing numbers are useful for inter-bank and inter-branch ACH transfers within the US. Chase Wire transfers have one domestic wire routing number for domestic transfers and the SWIFT code for international wire transfers.

To find your Chase routing number, refer to the table above. Alternatively, find it by logging in to your account at Chase.com, the Chase mobile app, or calling a Chase customer representative.

Before initiating any ACH or wire transfers, take some time to cross-check bank details with the recipient or your bank to ensure the routing number, the account number, and the recipient’s contact information is correct. It will save you unnecessary delays, costs, and stress after hitting “Send.”

TE PUEDE INTERESAR